Cryptocurrency Lawyer in Dubai

The rapid growth of digital assets has made cryptocurrencies a magnet for investors, enthusiasts, and fraudsters alike. From hacked wallets and investment scams to phishing schemes and fraudulent exchanges, crypto crimes account for billions in losses worldwide. Individuals involved in such cases often face frozen accounts, seized assets, and complex cross-border legal issues.

To protect yourself against such legal matters, consulting an International law firm immediately is critical. Our cryptocurrency lawyers in Dubai specialize in tracking fraudulent digital transactions, pursuing recovery, and holding the perpetrators accountable. We provide legal insights to help you fight back against crypto fraud and protect your assets.

What is cryptocurrency?

Cryptocurrencies are a digital form of payment based on blockchain technology. Unlike traditional fiat currencies like the USD or Euro, crypto assets are based on a decentralized finance network beyond the control of the central bank or a physical regulator. All the transactions are exclusively online, recorded in an open and secure ledger (the blockchain).

The blockchain technology makes cryptocurrency transparent and immune to counterfeiting as the transactions are recorded in immutable ledgers. This technology was popularized by Bitcoin, the first cryptocurrency launched in 2009. It was later followed by Ethereum, Litecoin, and thousands of other digital assets.

The main advantages of cryptocurrencies are fast international transfers, low fees, and the ability to control your funds without intermediaries. Many see cryptocurrencies as an investment tool, but due to high volatility, they can bring both profits and losses.

Cryptocurrency storage is carried out in special digital wallets protected by encryption keys. Access to the wallet essentially gives you access to the digital currency in the account. However, cryptocurrencies are more than an alternative to money. They represent a growing financial ecosystem transforming the global economy and how people store value.

Cryptocurrency Fraud in Dubai

Crypto fraud in Dubai is a type of deception that exploits the popularity of digital assets to get money or valuable information from people. Amid the rapid growth of interest in crypto investments in the UAE and the relative anonymity of transactions, such schemes find fertile ground even in a financially developed and technologically advanced jurisdiction like Dubai.

Perpetrators often disguise themselves as investment consultants, traders, or supposedly licensed crypto platforms. They promise high returns, use psychological pressure, sudden limited-time offers, or fake security guarantees. In some cases, fraudsters even hold personal meetings in business centres in Dubai to inspire trust.

Popular forms of fraud include fake crypto exchanges, securities fraud, pump-and-dump schemes and fake blockchain startup projects. They also include the old-fashioned ponzi schemes using crypto assets, phishing via WhatsApp and Telegram, and investment clubs offering fixed income.

Despite the fact that regulatory authorities of the UAE, including the Dubai Virtual Assets Regulatory Authority (VARA), are tightening control over crypto assets, fraudsters are still actively exploiting legal and technical loopholes. As such, users need to exercise maximum caution, verify companies’ licences, and not fall for promises of quick profits.

Types of crypto-fraud in Dubai

Dubai is rapidly becoming a global hub for digital assets and blockchain projects. However, the number of fraudulent schemes is also growing alongside the rapid development of the cryptocurrency industry.

Anonymity, decentralisation, and a lack of awareness among new investors make this market vulnerable — even in a technologically advanced metropolis like Dubai. Below are the most common types of crypto fraud faced by residents and visitors of the emirate.

- Ponzi schemes

Pyramid schemes in Dubai operate under the guise of crypto investments or financial communities. Payments to early investors are made at the expense of new contributors.

A well-known example is the international BitConnect scheme, whose participants suffered worldwide, including investors in the UAE. Such projects often have high promised returns and “automated trading bots”, creating false trust among the public. - Fake ICO (Initial Coin Offerings)

Fraudsters in Dubai may use the appearance of a legitimate crypto project to raise funds for the launch of a non-existent token. They have a polished website, a white paper, an alleged office in DIFC or Dubai Silicon Oasis, but after raising funds — they disappear. These schemes target both retail investors and wealthy clients. - Phishing attacks

One of the most common threats in the UAE is fake email newsletters sent on behalf of well-known crypto exchanges. Residents of Dubai receive emails supposedly from Binance or Kraken, requesting account verification. Clicking on the link leads to a fake website through which fraudsters gain access to victims’ wallets. These attacks are particularly active and spread through WhatsApp and Telegram. - Raffles and fake gifts

On social media, messages about supposedly free cryptocurrency giveaways from “Elon Musk”, “Binance Exchange,” or “Dubai Blockchain Week” are increasingly appearing. Participants are asked to transfer a small amount to receive a “bonus”. Such giveaways are 100% fraud. In Dubai, such fakes are actively spread at events, in chats, or even through personal meetings. - Investment traps

At forums and crypto-conferences in the UAE, one can encounter offers of “private” investments in early projects, allegedly with exclusive access and minimal risks. Often, these schemes lack a transparent legal structure and operate without a licence. Some of them disguise themselves as “family offices” or “funds” based in Dubai. - Insider trading

Although this type of financial crime is characteristic of all global markets, insider traders in Dubai use closed crypto circles to commit securities fraud. After gaining access to information about an upcoming token listing or a major deal, perpetrators purchase assets in advance to profit from a sharp price increase. - Fake mining

Under the guise of crypto farm in Ajman or cloud mining from Kazakhstan, residents of Dubai are offered to invest in supposedly profitable cryptocurrency mining. Often, the equipment either does not exist at all or the money goes offshore. Some fraudsters rent offices in Dubai Marina or Business Bay to create the illusion of a real business. - Token Sniping

This method has become popular in crypto trading in the UAE. Fraudsters issue tokens, pump up their price through advertising campaigns, and dump the assets as soon as the price reaches its peak. The remaining holders are left with worthless crypto tokens. Such schemes are often promoted through influencers on Instagram and TikTok. - Cloud mining

Fraudsters offer “profitable” smart contracts for cryptocurrency mining. The platform is well-designed with chat support, but no mining takes place. Victimised investors in Dubai complain about the inability to withdraw funds or the closure of the site a couple of months after its launch.

Crypto Crimes or Asset Freezing?

Specialized defense for cryptocurrency cases in Dubai. Challenging freezing orders and defending against money laundering charges.

Unblock Crypto AssetsGeneral signs of crypto fraud in Dubai

The recognition of cryptocurrency fraud indicators is particularly relevant in Dubai, a region where emerging technologies are actively developing, and interest in cryptocurrency investments is rapidly growing. Despite tightening regulations from the Dubai Virtual Assets Regulatory Authority ( VARA), fraudsters continue to adapt and seek new ways to deceive.

- Promises of unrealistic returns: Any guarantees of high profits or stories about “win-win” investments are the main red flag. In the world of finance, and especially in cryptocurrencies, returns are always associated with risk.

- Artificial creation of urgency: Fraudsters often use psychological pressure, claiming that the offer is “time-limited” or available only to the “selected”. Their goal is to make you take an impulsive decision when investing in digital assets. Always pause and conduct a thorough analysis.

- Lack of transparency: Legitimate projects take pride in their team, openly publish technical documentation (white paper), and have a clear roadmap. If information about the creators is hidden and the project’s goals are vague – stay away.

- Unexpected offers: Be extremely cautious if someone contacts you first with a “profitable offer” via email, Telegram, or other social networks. Serious investment opportunities do not seek clients through spam mailings.

- Problems with withdrawing funds: A classic sign of fraud, you easily deposit money but face insurmountable difficulties when trying to withdraw it. You may be asked to pay additional fees or taxes to unlock the account — this is a trick.

- Fake recommendations and reviews: Fraudsters often fabricate reviews and use the names of famous individuals or influencers without their knowledge to create an appearance of legitimacy. Always verify information through official sources.

- Aggressive marketing on social media: Beware of projects whose popularity is based solely on hype on Twitter, Instagram, or Telegram. Mass advertising and an army of bots are not indicators of reliability, but often just a tool for a “pump and dump” scheme.

Awareness of these signals is your main tool for navigating the complex and dynamic world of cryptocurrencies.

Methods of money laundering using cryptocurrencies

With the growing interest in digital assets in the UAE, including Dubai, malicious actors have begun actively using cryptocurrencies for money laundering. A popular method is layering, which involves repeatedly transferring funds through various crypto wallets to conceal their origin. Such a scheme complicates the tracking of the transaction chain.

Additionally, so-called cryptomixers (tumblers) are used, which mix funds and blur their connection to the source. Some criminals also use decentralised exchanges (DEX), which often do not fall under strict regulatory oversight, for anonymous cryptocurrency exchanges and the withdrawal of “cleaned” assets.

The authorities of the UAE, including the Dubai Financial Services Authority (DFSA) and the Central Bank, have tightened control over operations with digital assets. As such, authorities are actively implementing blockchain analysis tools to increase the transparency of crypto transactions and combat money laundering.

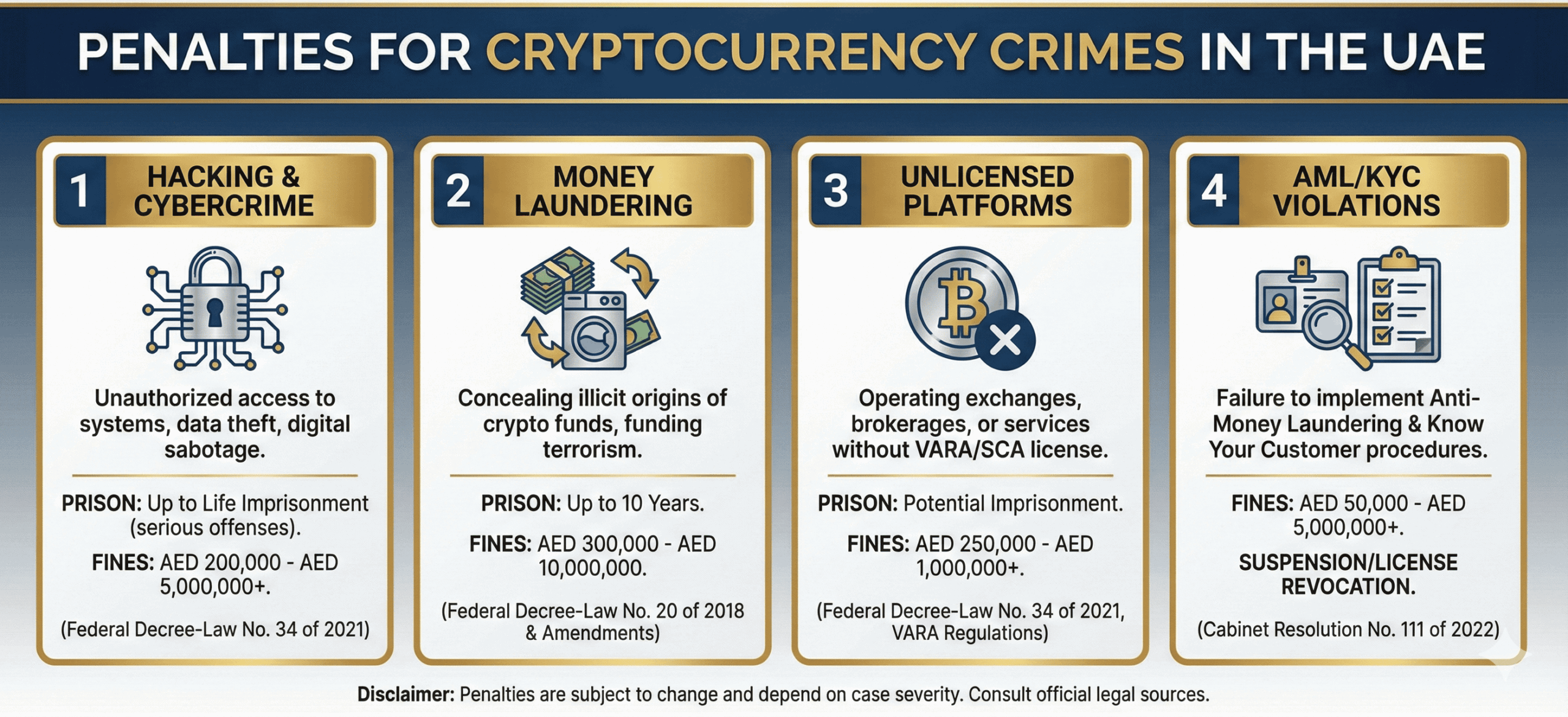

Important: Involvement in crypto fraud, wire fraud, or money laundering in the UAE entails severe sanctions, including prison sentences. In case of suspicion or accusation, contact a financial crimes lawyer in Dubai.

SIM card fraud in Dubai

The SIM-Swap fraud is one of the most alarming types of financial attacks in the UAE. Criminals use social engineering to transfer the victim’s phone number to a new SIM card under their control. That allows them to gain access to SMS with two-factor authentication codes and, consequently, to cryptocurrency wallets or accounts on exchanges.

In conditions where many users in Dubai still use SMS verification, the risk remains high. It is recommended to switch to authentication through applications (for example, Google Authenticator).

Freezing of a crypto account

In the UAE, crypto exchanges or banks can freeze an account if suspicious activity is detected to protect the user. If you encounter a freezing of funds, immediately contact the platform’s technical support, provide supporting documents, and if necessary, consult a lawyer for assistance with the appeal.

Legal assistance for crypto fraud in Dubai

Our legal team in Dubai provides professional support to victims of cryptocurrency fraud. We work with both individuals and companies affected by crypto scams. Our main areas:

- Investment Frauds Refunds: Legal support for complaints to law enforcement agencies and the Dubai Cybercrime Centre.

- Court proceedings: Lawsuit proceedings against fraudsters in the jurisdiction of the UAE or international representation.

- Regulatory support: Consultations on compliance with VARA requirements and other regulators in the UAE.

- Fraud investigation: Collection of evidence, transaction analysis, and assistance in legal case building.

- Work with banks and crypto exchanges: Conducting negotiations and protecting clients’ interests in case of account blocking or funds withholding.

- Prevention: Legal consultations for risk prevention and safe participation in the crypto market.

International affairs and cross-border assistance

Many crypto scammers operate outside the UAE, using offshore or anonymous platforms. Our team has experience in handling cross-border cases and international investigations. That includes cooperation with law enforcement agencies outside the UAE, like the US Securities and Exchange Commission.

If you have fallen victim to crypto fraud, our legal department in Dubai is ready to provide comprehensive support and help recover lost funds.

Contact us today

If you have encountered suspicious activity or become a victim of crypto scams in Dubai, do not delay. Our team of lawyers specialising in digital assets and financial crimes has extensive experience with commodities law, data privacy, and digital assets. We will provide you with a clear strategy, protection, and legal support necessary to restore justice.

Need consultation on cryptocurrency law in Dubai? Contact us today — we are ready to act.

FAQ

What does a crypto lawyer do?

A crypto lawyer is a legal specialist navigating blockchain technology, digital assets, and financial regulation. Their primary role is ensuring clients (exchanges, startups) comply with evolving laws, including AML/CFT protocols. In the UAE, this means specific compliance with the Virtual Asset Regulatory Authority (VARA) in Dubai and the SCA federally. They also structure ICOs, handle licensing for Virtual Asset Service Providers (VASPs), draft smart contracts, and represent clients in litigation related to crypto theft or fraud, assisting in asset recovery.

Is crypto legal in the UAE?

Yes, cryptocurrency is legal in the UAE, but it operates within one of the world’s most comprehensive regulatory frameworks. The UAE actively promotes itself as a global crypto hub. Regulation is managed by the SCA (federally) and the Central Bank of the UAE. Dubai has its own powerful regulator, the Virtual Asset Regulatory Authority (VARA) (excluding the DIFC). All Virtual Asset Service Providers (VASPs), such as exchanges, must obtain a VARA license to operate legally in Dubai. This framework focuses heavily on investor protection and AML/CFT compliance.

Is crypto theft a crime?

Yes, crypto theft is unequivocally a crime. Cryptocurrencies are legally recognized as virtual assets or property. Stealing them constitutes theft, fraud, or a cybercrime. In the UAE, crypto theft falls under Federal Decree-Law No. 34 of 2021 on Combating Cybercrimes. If theft involves hacking, a phishing scam, or identity theft, it is prosecuted under this law. Penalties are severe, often involving significant fines (up to AED 2,000,000) and imprisonment. The Dubai Police have specialized units to investigate these offenses.

What is the biggest risk with cryptocurrency?

The single biggest risk associated with cryptocurrency is extreme volatility. Prices can fluctuate wildly in very short periods, leading to substantial and rapid financial losses. Beyond volatility, other major risks include security vulnerabilities; cryptocurrencies are targets for hacking, phishing scams, and fraudulent schemes (e.g., “rug pulls”). If a user’s private keys are stolen, the funds are often irretrievable. Another significant risk is regulatory uncertainty. While jurisdictions like Dubai (via VARA) are creating clear rules, other countries may impose sudden bans.

Is having crypto illegal?

In the vast majority of jurisdictions, including the UAE, simply owning or “having” cryptocurrency is not illegal. The illegality arises from how cryptocurrency is used or acquired. It becomes illegal when used for illicit activities, such as money laundering, financing terrorism, or engaging in scams. Furthermore, operating a business that deals with crypto (like an exchange) without the proper license (e.g., a VARA license in Dubai) is illegal. For a private individual, possession is legal.